Gemini Leverage Trading 2024: A Beginner’s Guide

Well, let me tell ya, if you’ve heard the word “Gemini” and all this talk about “leverage trading” and you’re scratchin’ your head, don’t worry. It’s not as complicated as they try to make it sound. I’ll explain it in simple words, like how I’d tell my neighbor about it. So, Gemini leverage trading in 2024 is somethin’ a lot of folks are looking into, especially if they wanna make their money work a little harder, or maybe even a lot harder. But there are some things ya need to keep in mind, so don’t just jump in without knowing what you’re doing.

What is Gemini Leverage Trading?

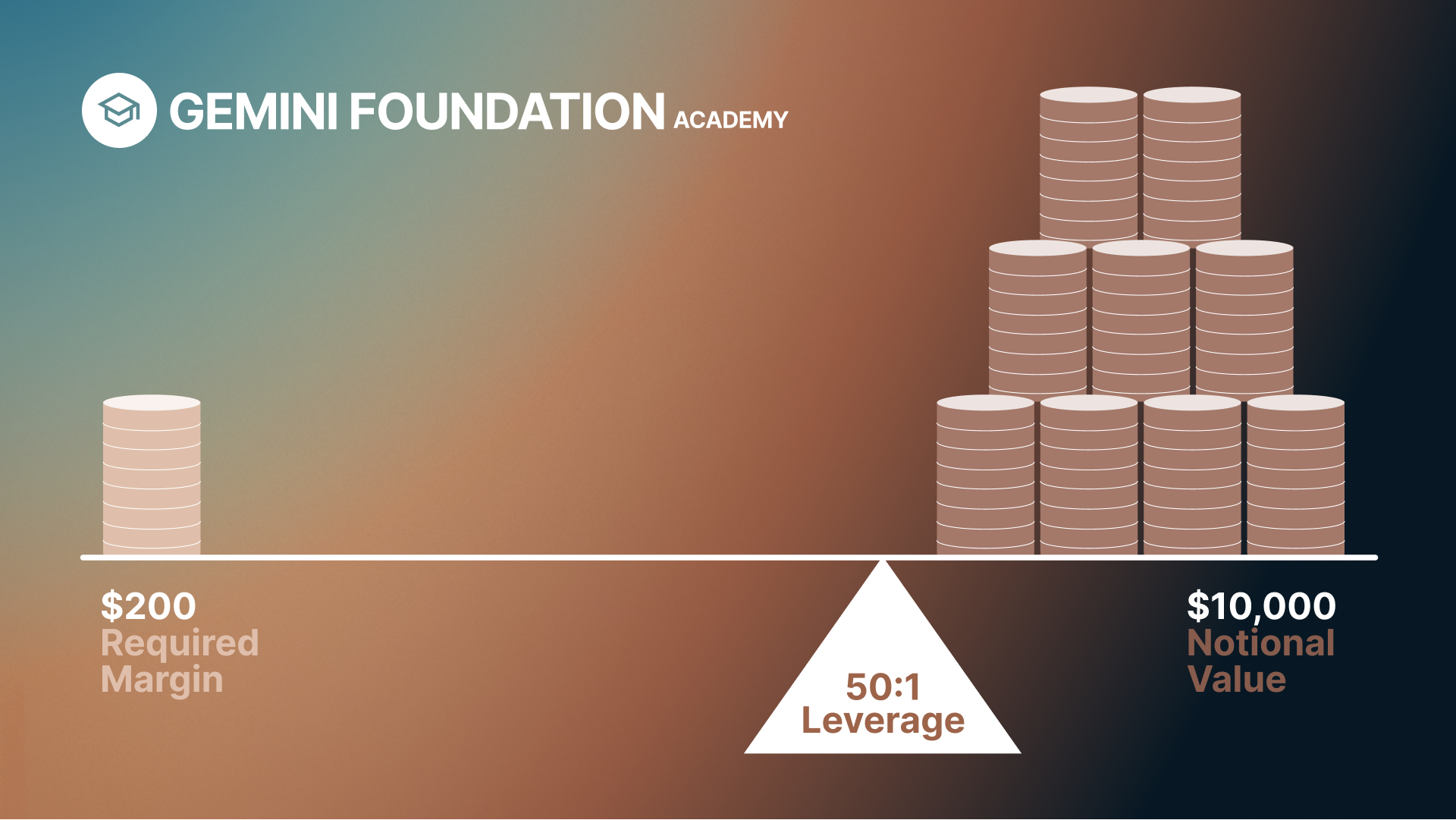

Now, Gemini is a platform where you can trade, mostly in cryptocurrencies. You know, like Bitcoin, Ethereum, and them other fancy coins. Leverage trading means you can borrow some extra funds to make bigger trades than what you got in your own account. Let’s say ya got $100, but with leverage, you can borrow $200 more from the platform and trade like you got $300. Sounds good, right? But, I’ll tell ya, it ain’t all sunshine and rainbows. Borrowing extra money means there’s a lot more risk involved, and if the market don’t go in your favor, you could lose more than what you started with. That’s a fact.

How Does Leverage Work on Gemini?

Now, let’s talk a little more about how leverage works on Gemini in 2024. You see, Gemini allows traders to use up to 100x leverage. That means you can trade up to 100 times more than what you’ve got. For example, if ya put in $10,000, you can borrow another $990,000 to make trades worth a million bucks! But hold on—before you get too excited, you gotta understand this ain’t no free lunch. If things go south, you might end up losing all that $10,000 you put in, and that’s a lot of money to lose.

Risk and Reward

With leverage, your profits can get bigger, but so can your losses. If the market goes up, you can make a nice profit real quick. But if it goes down, well, you’re gonna be in a hole real deep. This is where many people get in trouble—thinking they can control the market when really, it’s the market that controls everything. Some folks, especially new traders, get too greedy, use too much leverage, and end up losing it all. That’s just the way it goes sometimes. So, make sure you know how to manage your risks before ya dive in.

What Are the Risks of Using Leverage?

Well, I’ll tell ya, the risks are plenty. First, ya gotta know that using leverage means you’re borrowing money. Borrowing money means paying it back, no matter what happens. So, if the market goes the wrong way, you still gotta pay back what you borrowed. If things get too out of hand, Gemini might even close your position to prevent you from losing more than what you’ve put in. They call it a “margin call,” and trust me, you don’t want one of those. The more leverage you use, the more margin you need to keep your position open, and if the market falls too much, you could get forced out before you even knew what happened.

Gemini Leverage Trading Fees

Now, let’s talk about fees. Everything has a cost, and Gemini ain’t no different. If you’re using leverage, you’re gonna be paying some fees, too. These can include things like interest on the money you borrow, and also the fees for trading the actual assets themselves. Keep in mind that the longer you hold onto a position, the more fees you’ll rack up. So, before you start making big bets, make sure you understand what those fees will be. Ya don’t want to be surprised when you find out you owe more than what you’ve earned.

Is Gemini Leverage Trading for You?

Now, the big question is, should you even be messing with leverage trading in the first place? That’s up to you, but I’ll say this—leverage trading is for folks who know what they’re doing and are willing to take on the risk. If you’re just starting out in the world of crypto and trading, I’d recommend you start slow. You don’t need to go big right away. Get your feet wet, learn the ropes, and then decide if you wanna use leverage. If you don’t know much about trading or crypto, maybe better to sit this one out for now.

What Should You Keep in Mind in 2024?

Well, let me tell ya, 2024 is gonna be a bit different than previous years. With all the talk of regulations and things changing in the crypto world, it’s even more important to be careful. Some platforms like Gemini are tryin’ to make sure things are regulated and safe, but that don’t mean you can’t still lose your shirt. You gotta do your homework, read up on the latest rules, and keep an eye on the market. There’s a lot of volatility out there, and it can change on a dime.

Final Thoughts on Gemini Leverage Trading

So, to wrap it up, Gemini leverage trading in 2024 can be a way to make more money, but it’s risky. You need to understand the ins and outs of leverage before you use it, and always be ready for the possibility that things might not go your way. Don’t get too greedy, use it carefully, and only trade with money you’re willing to lose. And remember, trading is a game of patience and knowledge, not just luck. Take it slow, and you might just find success.

Tags:[Gemini Leverage Trading, Cryptocurrency Trading, 2024 Trading, Leverage, Risk in Trading, Margin Trading, Crypto Trading Tips]